The War on Student Loans

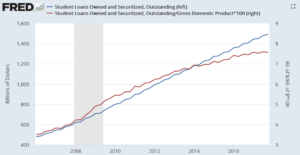

The decision on taking on student loans is an important one that many millennials have to endure. Student loans give millennials the chance to get an education in a career they want to pursue, but are loans negatively affecting their financial ability in the long run? MagnifyMoney, a service that researches financial products and compares them, analyzed data from the Federal Reserve 2016 and found that the average millennial that has student debt had 75 percent less net worth than others who were debt-free. They also found that graduates checking account balances were estimated at an average of $5,500, while for those who did not complete college, they had an average of $10,180. As more and more people attend college and continue racking up more student debt, the amount of total student debt still continues to increase. Retirement savings are lower for people who have student loans compared with people who don’t. Credit cards also pose a threat to these students because they use them for their needs, but they have high rates. Without knowing how to properly use a credit card, many millennials are wasting their money. On top of everything, student loans have high interest rates which make it almost impossible for a graduate to repay in a short-term basis. Moreover, something needs to be done to decrease the amount of student loans and to increase the net worth of graduates, whether that be colleges dropping the price of tuition or the government decreasing interest rates. How are millennials going to break from the burden of student loans?